Our Business

PT Alamtri Minerals Indonesia Tbk ("AMI" or "the Company") was established to be the center of AlamTri Group's non-coal mineral assets within the aspiration to build a bigger and greener AlamTri. AMI has several subsidiaries conducting metallurgical coal mining operations in addition to several subsidiaries established to carry out operations in minerals and mineral processing businesses.

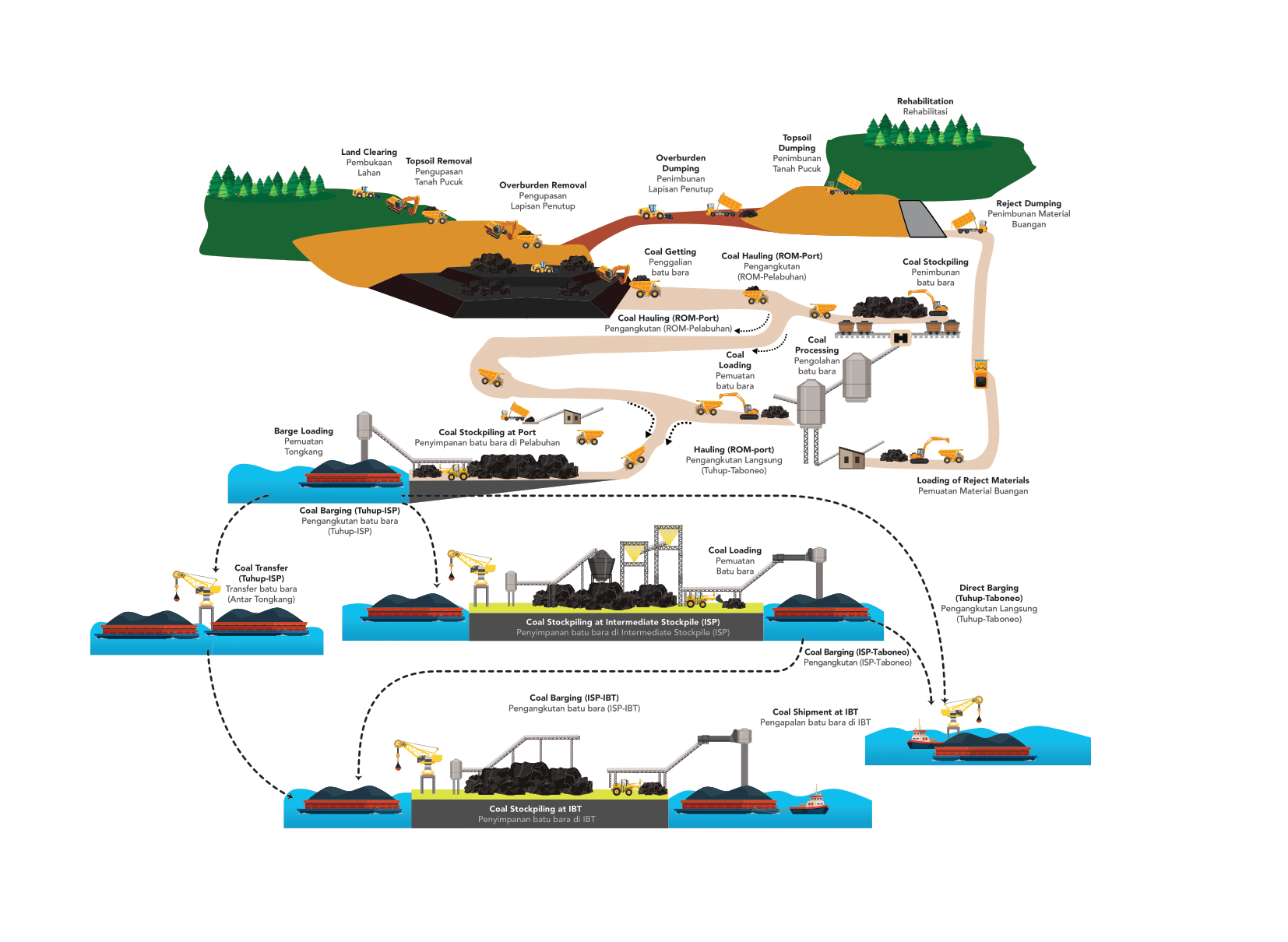

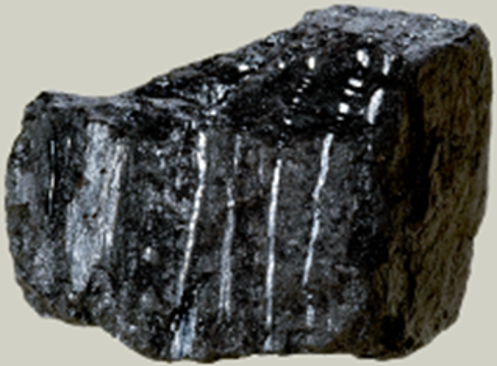

Metallurgical coal is an essential material for steel production. AMI's product has been warmly welcomed by the customers, particularly due to its low ash content, low phosphorous content, and high vitrinite content. As a part of the AlamTri Group, AMI and its subsidiaries enjoy the solid support of the integrated supply chain from the mine to the stockpile and the transshipment area. AMI also provides consultation services to the subsidiaries and offers mining services by leasing the crushing plant, located in PT Adaro Indonesia mine area in Wara, Tabalong regency, South Kalimantan province. The plant has been in operations since 2019 to crush and transfer coal to the stockpile through a conveyor of 800 ton per hour capacity. This equipment is currently leased to PT Adaro Indonesia with the production target of one million tonnes per year.

Meanwhile, AMI's subsidiary engaged in mineral processing is currently in the construction phase of an aluminum smelter in the world’s largest green industrial park in North Kalimantan. This business will play an important role in the Indonesian government's downstream initiatives and contribute to the development of a green economy.

More Details on Our Businesses

Metallurgical Coal Mining Operations

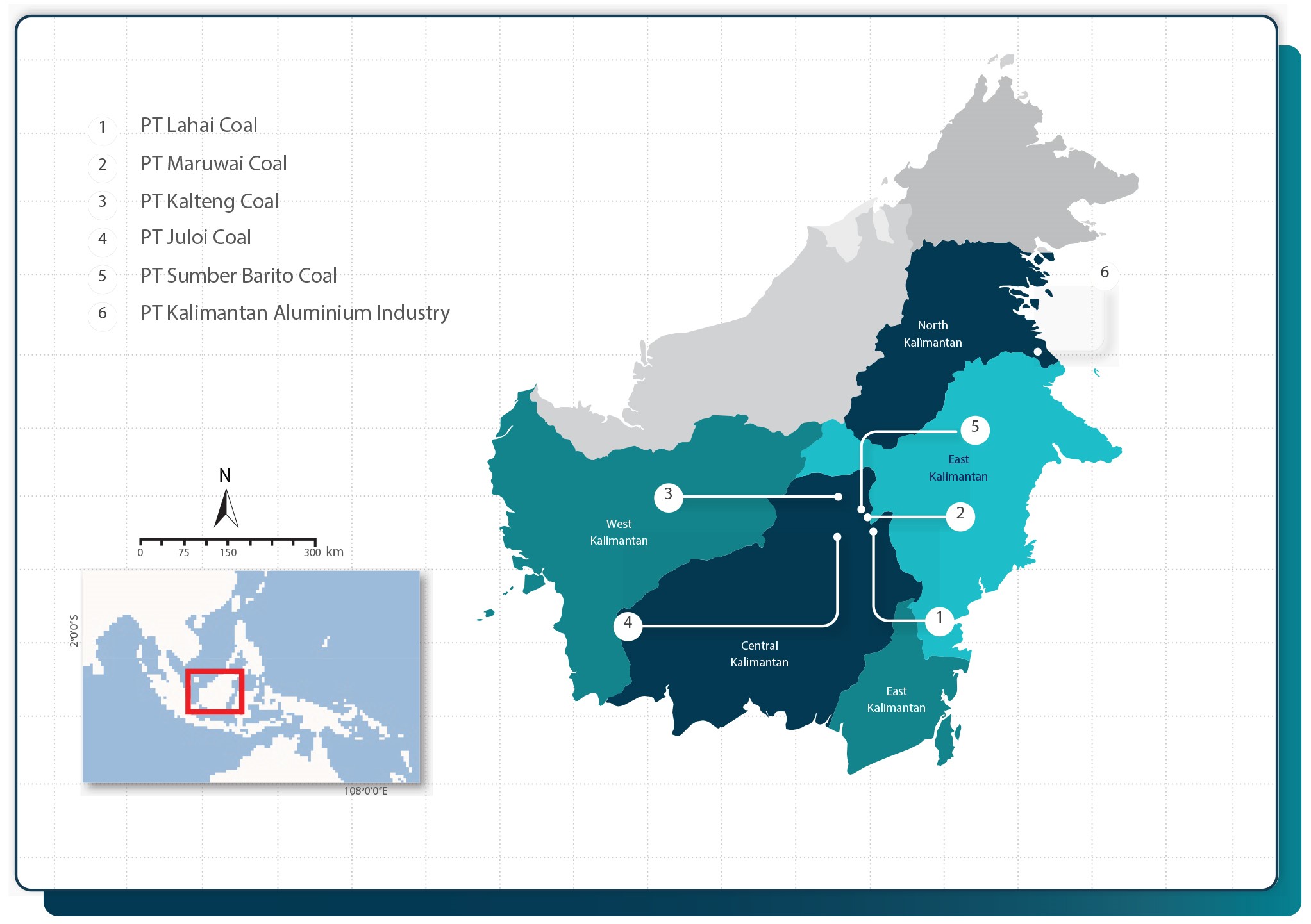

AMI conducts metallurgical coal mining activities through its five subsidiaries, each holding a Coal Contract of Work (CCoW). Collectively, these CCoWs stretch over an area of 146,579 ha with total coal reserves of 177.2 Mt and total coal resources of 982.9 Mt as of December 2024. These vast resources and reserves establish AMI’s position as one of the largest greenfield metallurgical coal projects globally.

The types of metallurgical coal owned by AMI are as follows:

- Hard Coking Coal (HCC)

HCC is the majority reserve owned by AMI. AMI's HCC has low ash and phosphorus content, moderate to high volatile matter content and low to moderate sulfur content. HCC has a high value-in-use compared to other types of coal. - Semi Hard Coking Coal (SHCC)

SHCC has a different RoMax value compared to HCC. When viewed from the strength of the coke produced, SHCC produces a lower coke strength than HCC so that its value-in-use tends to be lower than HCC. - Green Coal (GC)

GC is type of coal found in AMI's CCoW area, with a lower Crucible Swelling Number (CSN) value compared to HCC and SHCC. Based on the characteristics and quality, GC consists of Semi Soft Coking Coal and Pulverized Coal Injection. - Semi Soft Coking Coal (SSCC)

SSCC is coking coal with lower quality than HCC. AMI's SSCC coal has a low ash content, volatile matter content and moderate sulfur content. SSCC is also used in the steel processing industry as a mixer with HCC. - Pulverized Coal Injection (PCI)

PCI is used in steelmaking, sintering, smelting, and for injection into furnaces to reduce coke use.

AMI's metallurgical coal resources and reserves in five CCoW areas were calculated based on the updated coal resources and reserves estimation report carried out in August 2021 in accordance with the 2012 JORC Code. This demonstrates AMI's ability to generate sustainable economic performance and contribute to the country through its operations.

AMI’s coal resources classified into Measured, Indicated, and Inferred Resources are presented in the following table:

| CCoW/ Location |

Total Resources (milllion tonnes) |

Measured (million tonnes) |

Indicated |

Inferred |

| PT Juloi Coal - Bumbun (metallurgical coal) |

174.5 | 60.4 |

57.8 |

56.4 |

| PT Juloi Coal - Juloi Northwest (metallurgical coal) |

629.9 | - |

269.6 |

360.3 |

| PT Kalteng Coal - Luon (metallurgical coal) |

50.9 | 24.7 |

19.3 |

6.9 |

| PT Sumber Barito Coal (metallurgical coal) |

15.0 | 6.5 |

6.5 |

2.0 |

| PT Lahai Coal - Haju (metallurgical coal) |

3.4 | 3.0 |

0.4 |

0.1 |

| PT Lahai Coal - Bara (metallurgical coal) |

14.9 | 10.6 |

4.0 |

0.3 |

| PT Maruwai Coal - Lampunut (metallurgical coal) |

94.2 | 93.0 |

1.2 |

0.0 |

| Total | 982.9 | 198.1 | 358.8 | 426.0 |

The following information is AMI's estimated coal reserves classified in Proved and Probable are shown in the following table:

| Operating Company/ Project |

Total Reserves (million tonnes) |

Proved (million tonnes) |

Probable |

| PT Juloi Coal - Bumbun (metallurgical coal) |

55.5 | 0.0 |

55.5 |

| PT Kalteng Coal - Luon (metallurgical coal) |

17.7 | 0.0 |

17.7 |

| PT Sumber Barito Coal - Dahlia Arwana (metallurgical coal) |

5.6 | 0.0 |

5.6 |

| PT Lahai Coal - Haju (metallurgical coal) |

1.5 | 1.5 |

- |

| PT Lahai Coal - Bara (metallurgical coal) |

10.8 | 7.6 |

3.2 |

| PT Maruwai Coal - Lampunut (metallurgical coal) |

86.1 | 84.6 |

1.5 |

| Total | 177.2 | 93.7 |

83.5 |

The First Foothold in Mineral Processing

Indonesian government has launched the down streaming program of the mining sector to increase export values, create job opportunities, and improve economic condition of the local communities. This move was responded with the establishment of PT Kalimantan Aluminium Industry (KAI) in 2022, marking AMI’s first business penetration into the metal refining industry. In particular, KAI was designated to focus on producing aluminium ingots from an aluminium smelter located in an industrial estate in the North Kalimantan province.

The smelter will operate to fill the gap between the aluminium supply and demand, with the demand projected to continue growing significantly to meet the higher requirements across various sectors, such as automotive, construction, packaging, and aerospace. The smelter and its supporting facilities have been under development since 2023 and have been showing good progress to start the operation of the initial few aluminium smelter pots, targeted for the end of 2025.